Tradução e análise de palavras por inteligência artificial ChatGPT

Nesta página você pode obter uma análise detalhada de uma palavra ou frase, produzida usando a melhor tecnologia de inteligência artificial até o momento:

- como a palavra é usada

- frequência de uso

- é usado com mais frequência na fala oral ou escrita

- opções de tradução de palavras

- exemplos de uso (várias frases com tradução)

- etimologia

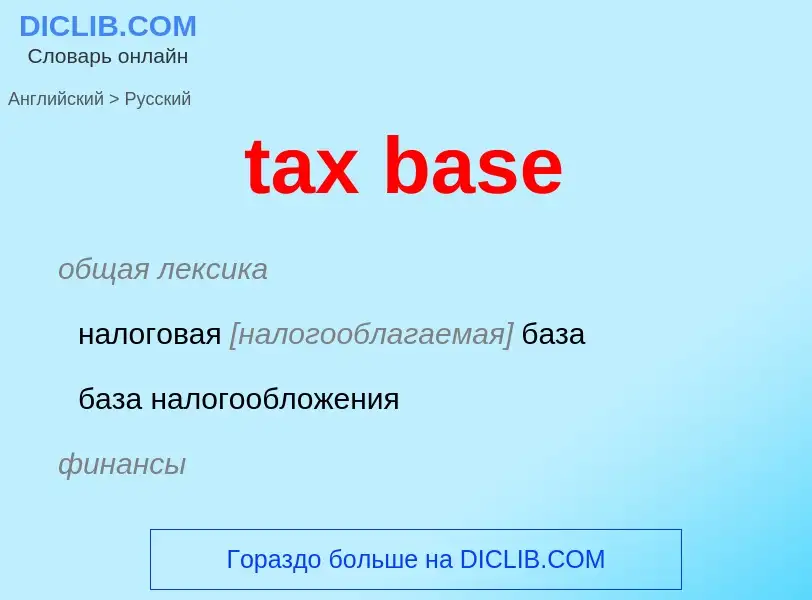

tax base - tradução para Inglês

общая лексика

налоговая [налогооблагаемая] база

база налогообложения

финансы

(стоимостная, физическая или иная характеристика облагаемого налогом объекта, служащая основой для расчета величины налоговых обязательств (напр., стоимость имущества для расчета налога на имущество, величина наследства для расчета налога на наследование и дарение, величина прибыли для налога на прибыль, количество импортируемого товара для некоторых налогов на импорт и т. д.))

синоним

2) обложение || облагать налогом или пошлиной

3) амер. разг. размер счёта

4) амер. членские взносы || взимать членские взносы

5) амер. разг. назначать или спрашивать цену

- after tax

- before tax

- tax free

- tax in kind

- liable to a tax

- tax on accumulation of profits

- tax on capital

- tax on income

- tax on investments

- tax on profits

- abate a tax

- abolish a tax

- collect taxes

- cut down a tax

- dodge a tax

- evade a tax

- impose a tax

- tax income

- lay a tax on

- make a tax

- pay taxes

- raise taxes

- withhold taxes

- accrued tax

- accumulated-earnings tax

- ad valorem tax

- agricultural tax

- airport tax

- alcohol tax

- amusement tax

- antichain store taxes

- apportioned tax

- assessed taxes

- burdensome taxes

- business tax

- capital-gains tax

- capital transfer tax

- capitation tax

- chain-store tax

- city tax

- "class" tax

- commodity tax

- company income tax

- consumption tax

- corporation income tax

- death tax

- deferred tax

- depreciated currency tax

- direct tax

- dividends tax

- double tax

- earmarked taxes

- effluent tax

- emergency tax

- employer payroll tax

- employment tax

- equalization tax

- estate tax

- excess profits tax

- excise tax

- export tax

- farm taxes

- farmer's tax

- federal tax

- flat-rate tax

- franchise tax

- general property tax

- gift tax

- graded tax

- graduated tax

- graduated income tax

- head tax

- hidden taxes

- highway tax

- highway users tax

- immovable property tax

- import tax

- import turnover tax

- income tax

- increment value tax

- indirect tax

- individual income tax

- inflation tax

- inheritance tax

- initiation tax

- interest equalization tax

- intermediate taxes

- land tax

- legacy tax

- local tax

- lost tax

- lump-sum tax

- luxuries tax

- matured tax

- multistage sales tax

- municipal tax

- national tax

- negative income tax

- net worth tax

- occupational tax

- payroll tax

- personal property tax

- poll tax

- privilege tax

- processing tax

- profits tax

- progressive tax

- property tax

- proportional tax

- punitive tax on retained earnings

- purchase tax

- real estate tax

- receipts tax

- regressive tax

- retail sales tax

- retirement taxes

- returnable tax

- salary tax

- sales tax

- salt tax

- security transfer taxes

- selective employment tax

- severance tax

- shared tax

- single tax

- single-stage sales tax

- social insurance tax

- social security tax

- stamp tax

- state tax

- stockholder's tax

- stock transfer tax

- sumptuary tax

- super tax

- supplemental tax

- tobacco tax

- tonnage tax

- transfer tax

- turnover tax

- undistributed profit tax

- use tax

- use tax on automobiles

- value-added tax

- wage tax

- wealth tax

- withholding tax

Definição

Wikipédia

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner (non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money or as its labor equivalent.

Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat percentage rate of taxation on personal annual income, but most scale taxes are progressive based on brackets of annual income amounts. Most countries charge a tax on an individual's income as well as on corporate income. Countries or subunits often also impose wealth taxes, inheritance taxes, estate taxes, gift taxes, property taxes, sales taxes, use taxes, payroll taxes, duties and/or tariffs.

In economic terms, taxation transfers wealth from households or businesses to the government. This has effects on economic growth and economic welfare that can be both increased (known as fiscal multiplier) or decreased (known as excess burden of taxation). Consequently, taxation is a highly debated topic by some, as although taxation is deemed necessary by general consensus in order for society to function and grow in an orderly and equitable manner through the government provision of public goods and public services, others such as libertarians and anarcho-capitalists are anti-taxation and denounce taxation broadly or in its entirety, classifying taxation as theft or extortion through coercion along with the use of force.

![Pyramid Age]]) Pyramid Age]])](https://commons.wikimedia.org/wiki/Special:FilePath/Wells egyptian peasants taxes.jpg?width=200)